What Is The Most Effective Indirect Method The Fed Uses To Change The Money Multiplier?

Chapter 28. Monetary Policy and Bank Regulation

28.iii How a Primal Bank Executes Monetary Policy

Learning Objectives

By the end of this section, you will be able to:

- Explain the reason for open up marketplace operations

- Evaluate reserve requirements and discount rates

- Interpret and show bank activity through residue sheets

The virtually of import part of the Federal Reserve is to conduct the nation's monetary policy. Commodity I, Section viii of the U.S. Constitution gives Congress the power "to coin money" and "to regulate the value thereof." Equally function of the 1913 legislation that created the Federal Reserve, Congress delegated these powers to the Fed. Monetary policy involves managing interest rates and credit weather condition, which influences the level of economic activity, as described in more detail beneath.

A key bank has three traditional tools to implement monetary policy in the economic system:

- Open up market operations

- Changing reserve requirements

- Changing the discount rate

In discussing how these three tools work, information technology is useful to retrieve of the central bank every bit a "bank for banks"—that is, each private-sector banking concern has its own account at the primal depository financial institution. We will discuss each of these budgetary policy tools in the sections below.

Open Market place Operations

The most commonly used tool of monetary policy in the U.S. is open market operations. Open up market place operations have place when the central bank sells or buys U.S. Treasury bonds in order to influence the quantity of bank reserves and the level of interest rates. The specific interest rate targeted in open market place operations is the federal funds charge per unit. The name is a fleck of a misnomer since the federal funds rate is the involvement charge per unit charged past commercial banks making overnight loans to other banks. Equally such, it is a very short term interest charge per unit, but one that reflects credit atmospheric condition in financial markets very well.

The Federal Open up Marketplace Commission (FOMC) makes the decisions regarding these open market operations. The FOMC is made upwardly of the seven members of the Federal Reserve'due south Board of Governors. It also includes five voting members who are drawn, on a rotating footing, from the regional Federal Reserve Banks. The New York district president is a permanent voting fellow member of the FOMC and the other 4 spots are filled on a rotating, almanac basis, from the other 11 districts. The FOMC typically meets every six weeks, but it tin encounter more than frequently if necessary. The FOMC tries to deed by consensus; however, the chairman of the Federal Reserve has traditionally played a very powerful role in defining and shaping that consensus. For the Federal Reserve, and for most primal banks, open marketplace operations have, over the last few decades, been the most commonly used tool of budgetary policy.

Visit this website for the Federal Reserve to learn more virtually current budgetary policy.

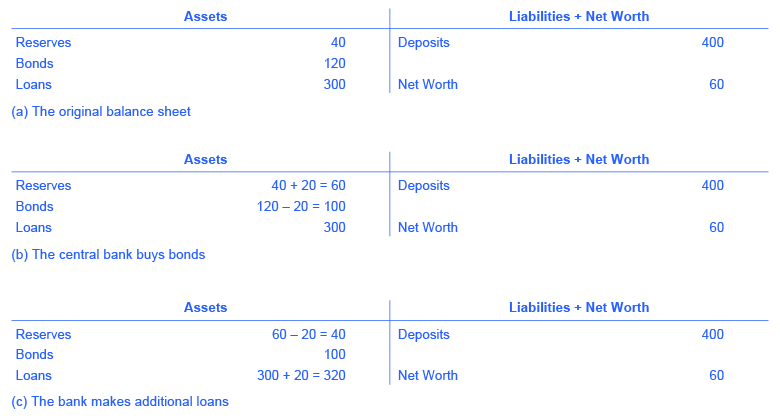

To understand how open marketplace operations touch on the money supply, consider the remainder sheet of Happy Bank, displayed in Figure 1. Figure 1 (a) shows that Happy Bank starts with $460 million in assets, divided among reserves, bonds and loans, and $400 million in liabilities in the form of deposits, with a cyberspace worth of $60 million. When the key bank purchases $20 1000000 in bonds from Happy Depository financial institution, the bail holdings of Happy Bank fall past $20 one thousand thousand and the bank's reserves rise by $20 meg, as shown in Figure 1 (b). Even so, Happy Bank only wants to concord $40 million in reserves (the quantity of reserves that information technology started with in Effigy 1) (a), so the bank decides to loan out the extra $20 million in reserves and its loans ascension by $xx million, as shown in Figure 1 (c). The open up market place operation by the cardinal banking company causes Happy Banking concern to make loans instead of property its assets in the form of authorities bonds, which expands the money supply. As the new loans are deposited in banks throughout the economy, these banks will, in turn, loan out some of the deposits they receive, triggering the money multiplier discussed in Money and Cyberbanking.

Where did the Federal Reserve get the $20 million that it used to purchase the bonds? A fundamental banking concern has the ability to create money. In practical terms, the Federal Reserve would write a check to Happy Bank, so that Happy Bank can have that money credited to its bank account at the Federal Reserve. In truth, the Federal Reserve created the money to buy the bonds out of thin air—or with a few clicks on some computer keys.

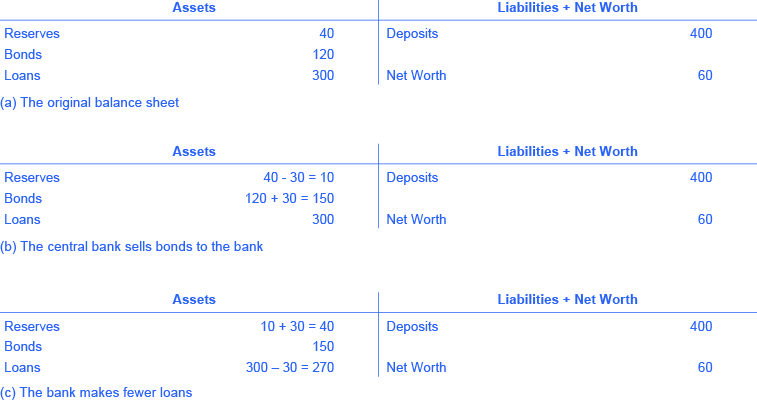

Open market operations tin also reduce the quantity of money and loans in an economic system. Figure 2 (a) shows the balance sheet of Happy Banking company before the central bank sells bonds in the open market. When Happy Bank purchases $30 million in bonds, Happy Bank sends $30 million of its reserves to the fundamental depository financial institution, only at present holds an boosted $thirty million in bonds, as shown in Figure 2 (b). However, Happy Banking concern wants to hold $twoscore 1000000 in reserves, as in Figure ii (a), so it will arrange down the quantity of its loans by $30 one thousand thousand, to bring its reserves back to the desired level, as shown in Figure 2 (c). In applied terms, a banking concern tin can hands reduce its quantity of loans. At any given fourth dimension, a bank is receiving payments on loans that it made previously and also making new loans. If the bank just slows downwardly or briefly halts making new loans, and instead adds those funds to its reserves, so its overall quantity of loans will subtract. A decrease in the quantity of loans also means fewer deposits in other banks, and other banks reducing their lending besides, every bit the coin multiplier discussed in Money and Cyberbanking takes effect. And what about all those bonds? How do they affect the coin supply? Read the following Clear Information technology Up feature for the answer.

Does selling or ownership bonds increment the coin supply?

Is information technology a auction of bonds by the central banking concern which increases depository financial institution reserves and lowers interest rates or is it a purchase of bonds past the central depository financial institution? The like shooting fish in a barrel mode to keep track of this is to care for the central depository financial institution as existence outside the cyberbanking system. When a central banking company buys bonds, coin is flowing from the primal banking company to private banks in the economy, increasing the supply of money in circulation. When a central bank sells bonds, so money from individual banks in the economy is flowing into the key banking concern—reducing the quantity of coin in the economy.

Changing Reserve Requirements

A 2d method of conducting monetary policy is for the central bank to heighten or lower the reserve requirement, which, as we noted earlier, is the percentage of each banking concern'due south deposits that information technology is legally required to concur either as cash in their vault or on eolith with the primal banking company. If banks are required to hold a greater corporeality in reserves, they have less money bachelor to lend out. If banks are allowed to hold a smaller corporeality in reserves, they volition have a greater amount of coin available to lend out.

In early 2015, the Federal Reserve required banks to hold reserves equal to 0% of the first $fourteen.five million in deposits, then to hold reserves equal to 3% of the deposits upwards to $103.vi one thousand thousand, and 10% of any amount above $103.6 million. Small changes in the reserve requirements are made almost every year. For instance, the $103.6 million dividing line is sometimes bumped up or downwards by a few million dollars. In do, large changes in reserve requirements are rarely used to execute monetary policy. A sudden need that all banks increment their reserves would be extremely disruptive and difficult to comply with, while loosening requirements besides much would create a danger of banks existence unable to meet the need for withdrawals.

Changing the Discount Rate

The Federal Reserve was founded in the aftermath of the Financial Panic of 1907 when many banks failed as a outcome of bank runs. As mentioned earlier, since banks make profits by lending out their deposits, no bank, even those that are not bankrupt, can withstand a bank run. As a effect of the Panic, the Federal Reserve was founded to be the "lender of last resort." In the event of a bank run, sound banks, (banks that were non bankrupt) could borrow as much cash equally they needed from the Fed's disbelieve "window" to quell the banking company run. The interest rate banks pay for such loans is called the discount rate. (They are so named considering loans are fabricated against the bank'due south outstanding loans "at a disbelieve" of their confront value.) Once depositors became convinced that the bank would exist able to honor their withdrawals, they no longer had a reason to make a run on the bank. In brusque, the Federal Reserve was originally intended to provide credit passively, but in the years since its founding, the Fed has taken on a more than active role with budgetary policy.

And then, the third traditional method for conducting monetary policy is to raise or lower the discount charge per unit. If the central banking company raises the discount rate, and then commercial banks will reduce their borrowing of reserves from the Fed, and instead call in loans to replace those reserves. Since fewer loans are available, the money supply falls and market interest rates rise. If the central depository financial institution lowers the disbelieve rate it charges to banks, the procedure works in reverse.

In recent decades, the Federal Reserve has fabricated relatively few discount loans. Before a bank borrows from the Federal Reserve to fill out its required reserves, the bank is expected to first infringe from other available sources, like other banks. This is encouraged by Fed's charging a higher disbelieve charge per unit, than the federal funds rate. Given that near banks infringe little at the discount rate, changing the disbelieve rate upwards or down has trivial touch on their beliefs. More chiefly, the Fed has found from experience that open market place operations are a more precise and powerful means of executing any desired monetary policy.

In the Federal Reserve Act, the phrase "…to afford means of rediscounting commercial paper" is contained in its long title. This tool was seen every bit the primary tool for monetary policy when the Fed was initially created. This illustrates how monetary policy has evolved and how it continues to practise and then.

Key Concepts and Summary

A central bank has three traditional tools to conduct monetary policy: open up market operations, which involves ownership and selling government bonds with banks; reserve requirements, which decide what level of reserves a banking concern is legally required to hold; and discount rates, which is the involvement rate charged by the central bank on the loans that it gives to other commercial banks. The most usually used tool is open up market operations.

Cocky-Cheque Questions

- If the central bank sells $500 in bonds to a bank that has issued $ten,000 in loans and is exactly meeting the reserve requirement of 10%, what will happen to the amount of loans and to the money supply in full general?

- What would be the effect of increasing the reserve requirements of banks on the coin supply?

Review Questions

- Explain how to use an open market operation to aggrandize the money supply.

- Explain how to apply the reserve requirement to expand the money supply.

- Explicate how to use the disbelieve charge per unit to expand the money supply.

Critical Thinking Questions

Explain what would happen if banks were notified they had to increase their required reserves by 1 percentage point from, say, 9% to10% of deposits. What would their options be to come up with the cash?

Problems

- Suppose the Fed conducts an open market purchase past buying $10 million in Treasury bonds from Acme Banking company. Sketch out the rest sail changes that will occur every bit Top converts the bond sale proceeds to new loans. The initial Height depository financial institution residual sail contains the following information: Assets – reserves thirty, bonds 50, and loans l; Liabilities – deposits 300 and disinterestedness 30.

- Suppose the Fed conducts an open market sale past selling $10 million in Treasury bonds to Height Bank. Sketch out the balance sheet changes that will occur as Acme restores its required reserves (ten% of deposits) by reducing its loans. The initial balance sheet for Peak Banking company contains the following information: Assets – reserves 30, bonds l, and loans 250; Liabilities – deposits 300 and disinterestedness 30.

References

Board of Governors of the Federal Reserve System. "Federal Open up Market place Committee." Accessed September 3, 2013. http://www.federalreserve.gov/monetarypolicy/fomc.htm.

Board of Governors of the Federal Reserve System. "Reserve Requirements." Accessed November 5, 2013. http://www.federalreserve.gov/monetarypolicy/reservereq.htm.

Cox, Jeff. 2014. "Fed Completes the Taper." Accessed March 31, 2015. http://www.cnbc.com/id/102132961.

Jahan, Sarwat. n.d. "Inflation Targeting: Holding the Line." International Monetary Fund. Accessed March 31, 2015. http://www.international monetary fund.org/external/pubs/ft/fandd/basics/target.htm.

Glossary

- discount charge per unit

- the interest rate charged past the cardinal bank on the loans that it gives to other commercial banks

- open market place operations

- the fundamental bank selling or ownership Treasury bonds to influence the quantity of money and the level of interest rates

- reserve requirement

- the percentage amount of its total deposits that a banking concern is legally obligated to to either hold equally cash in their vault or deposit with the central banking concern

Solutions

Answers to Self-Cheque Questions

- The bank has to hold $one,000 in reserves, and so when it buys the $500 in bonds, it will accept to reduce its loans by $500 to make up the difference. The money supply decreases past the aforementioned amount.

- An increase in reserve requirements would reduce the supply of coin, since more coin would be held in banks rather than circulating in the economy.

Source: https://opentextbc.ca/principlesofeconomics/chapter/28-3-how-a-central-bank-executes-monetary-policy/

Posted by: litchfordsagems66.blogspot.com

0 Response to "What Is The Most Effective Indirect Method The Fed Uses To Change The Money Multiplier?"

Post a Comment